Mobility Strikes Back – Top 10 Trending Topics

February 17, 2023 Admin Blogs

The EPM Advisory Council, an automotive industry consortium comprised of executives that are studying all aspects of mobility and customer experiences, met toward the end of 2022 to discuss the top 10 industry trends impacting the mobility experience in 2022. Also, they discussed how those trends were likely to continue in 2023 based on market conditions. This blog post summarizes thoughts that emerged for the top 10 trending topics influencing experience in 2023.

Once thought to be on the brink of extinction with the creation of the shared mobility segment, personal automobile ownership has taken a sharp positive turn. EVs, software-defined vehicles (SDVs), autonomous vehicles and more have reignited the category.

Innovation is the name of the game and it’s in that spirit that the EPM Advisory Council recently convened to discuss the most compelling trending topics in the automotive space. Let’s take a look at the new trends and how they will evolve over time.

- Inventory to Improve

Due to the pandemic, supply chain issues and the microchip shortage, the consumer has been faced with a new normal of empty dealer lots and escalating prices. Consumers have been forced to pay more for new and used cars, delay purchases or consider alternatives like ridesharing. As the microchip shortage eases, production, inventory and pricing will continue to improve and offer consumers more options.

In an effort to reduce reliance on Chinese-made semiconductor chips, the United States government has committed to investing in semiconductor companies to expand domestic manufacturing. A $52 billion executive order is intended to entice hardware companies back to the US with a 25% tax credit for companies investing in US semiconductor manufacturing.

OEMs will also look to build closer relationships with custom chip makers and work together on solutions. Manufacturers will move from an arm’s-length relationship to long-term agreements and even risk sharing. They’ll also engage multiple suppliers to mitigate supply chain issues moving forward.

- Sharing Spaces

The supply challenges this past year as well as changing consumer preferences have driven the demand for shared mobility. Riders are facing widespread driver shortages and sky-high prices, especially in big cities.

As consumers continue to seek flexibility to choose the best solution for a specific purpose, entirely new segments of specialized vehicles will follow. McKinsey projects that up to one out of ten cars sold in 2030 may be a shared vehicle, designed for heavy use, additional mileage and comfort.

- Alexa vs. Afeela – The New Battlefield

As consumer demand for connected services, autonomous vehicles, shared mobility and electrification technologies (CASE) increases, traditional car manufacturers must compete with new entrants globally. Consider Amazon’s latest technology that allows drivers to use Alexa to find EV charging locations and initiate a charge with EVgo.

Not to be outdone, Honda and Sony have joined forces to create Afeela, a new electric car brand that promises to combine Honda’s automotive expertise with Sony’s experience in AI, entertainment, VR and AR. With Afeela, passengers will experience the sensation of interactive mobility where it detects and understands their needs through sensing and AI technologies.

- Game On

Entertainment has moved to the front seat as cockpit domain controllers give drivers a seamless and immersive experience from music to navigation and communication. With this change, OEMs can now take the gaming experience on the road to offer more entertainment solutions to all passengers or during EV charging.

In-vehicle gaming applications were a major theme at CES. Hyundai Motor Group, Polestar and BYD announced that they will be offering NVIDIA’s cloud-based gaming service in select new models. Cadillac will include in-vehicle gaming in their Lyriq model while Volkswagen’s CARIAD shared their vision to bring streaming games to market.

- EVs Everywhere

It’s no surprise that EVs stole the show at CES. According to a PwC report, EV adoption rates in the US will rise from 2% now to 44% by 2035, with China and EU markets surging even more. Many factors are driving demand – from rising fuel costs to concerns about carbon emissions.

As consumers want to feel good about their purchase and their footprint, local municipalities are taking it one step further by creating a regulatory path to zeroemission vehicles. California plans to ban sales of new gas cars by 2035 and several other states have established mandates to reduce gas-powered vehicles in favor of EVs by the 2030s.

Federal tax credits on EV purchases are designed to further incentivize category growth. US consumers who purchase a used EV qualify for up to a $4,000 credit while those who buy a new plug-in EV or fuel cell electric vehicle qualify for up to a $7,500 credit.

This all comes as Chinese OEMs aggressively enter Europe with mid-price EV brands. The country exported $3.2 billion of EVs in November of 2022, up 165% from previous year, to the highest-ever monthly total. Chinese brands in the US may be rare at the moment but the wave is expected to reach it soon.

- Updates Made Easy

Tesla may be best well-known for the concept of the updatable vehicle, but major automakers are all participating in this next evolution of the automotive industry. Consumers expect the car to be an extension of their digital life and smartphone – and SDVs offer that customizable experience.

With differentiation now driven by software, OEMs are embracing cloud-native computing to enable fast deployment of updates and new features and functions. From Qualcomm to Garmin, high-tech entrants were all over the show floor at CES displaying their considerable investment in the space.

HARMAN’s Ready Upgrade allows drivers to add and upgrade vehicle features as easily as they would with their smartphones. Meanwhile, BlackBerry’s IVY in-vehicle software platform uses cloud-controlled access to vehicle data to predict maintenance and offer in-vehicle secure payments with Alexa.

- Consumers Want Control

Autonomous pilots have popped up in markets across the country from Zoox (Amazonacquired start-up) in the Bay Area, Seattle and Las Vegas, to Waymo’s fee-charging driverless robotaxis in Phoenix. While much has been written about the future of fully autonomous driving, we anticipate this year to be more practically focused on lower levels of autonomy, requiring drivers to stay in control while allowing the vehicle to handle steering, acceleration and braking.

Mercedes-Benz plans to unveil their SAE L2 Automatic Lane Change Feature as well as an SAE L3 DRIVE PILOT system in Nevada and California this year. Safety will continue to be a significant concern as many consumers feel autonomous vehicles cannot fully simulate human response, especially if something goes wrong on the road.

CES suppliers emphasized their lidar innovations to help vehicles “see” their surroundings which will become more commonplace in the years to come.

OTA software updates will also play a critical role in autonomous driving. There must be strict control over user access to ensure vehicles are not “highjacked” from the outside. Cyber security is critical as the damage that could be caused by malicious actors is enormous.

- The Living Room Becomes a Moving Room

With so much time spent on the road, drivers want a living room experience in the car. Design is king and consumers demand slim displays with full HD and brilliant color.

The entire windshield becomes the HUD in BMW’s I Vision Dee, which stands for Digital Emotional Experience. The vehicle showcases what’s possible when hardware and software merge – transforming the car into an intelligent companion.

Apple has major plans to take over every screen in the car. The vision is to deeply integrate CarPlay allowing it to display information across multiple screens in the car. A connected iPhone will communicate and integrate with the vehicle in real time. As an example, a new CarPlay feature will allow users to tap an app to navigate to a pump and buy gas straight from an in-vehicle screen.

The car exterior now also becomes a screen with displays showing everything from weather to sports. The opportunities for advertising personalization and monetization are significant. Providers who can bring it all together in a moving vehicle are poised to reap big rewards.

- Swipe, Click, Buy

From Metaverse showrooms to trade valuations and digital contracts, digital retail delivers the connected, convenient car-buying experience that consumers demand. We expect to see even more of this with the EV car-buying experience.

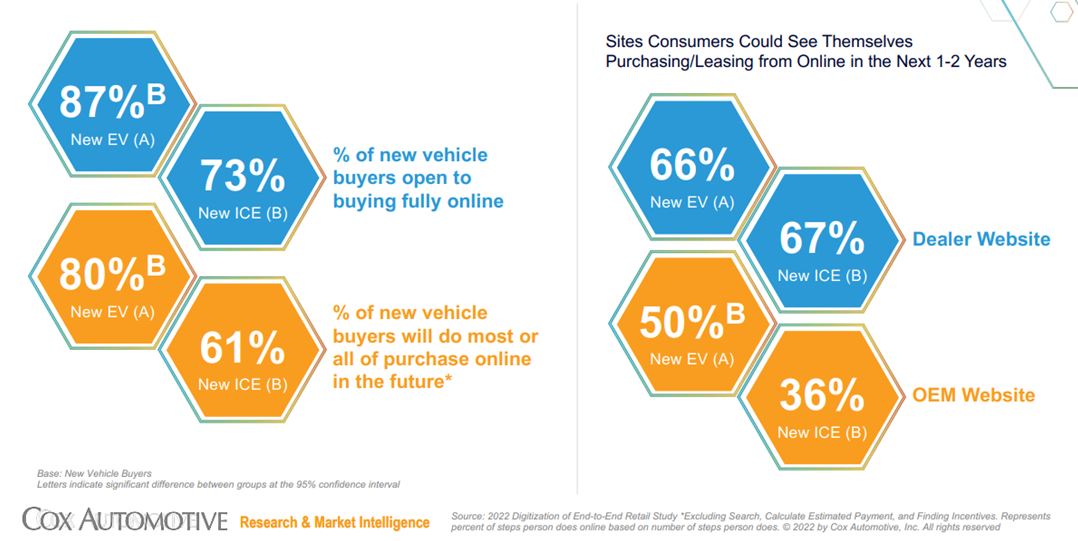

A recent industry study notes that up to two-thirds of all car buyers use digital automotive retail channels to search for their next vehicle purchase compared to 71% of all EV buyers. In fact, 87% of new EV buyers are open to buying fully online according to Cox Automotive – with two out of three open to purchasing/leasing from a dealer website.

That said, in-person interaction will always play a role in the buying decision. Consumers need to experience the product and try before they buy. Brick and mortar showrooms are stepping up their game to connect the physical and the digital worlds. Success for both OEMs and dealers will require the cultivation of a seamless, integrated customer journey.

10. Green Matters

From batteries to tires, the global automotive industry is keenly focused on reducing its impact on the environment to address consumer concern. Manufacturers and suppliers are accelerating their sustainability practices and product development.

Goodyear is pushing forward with a BetterFuture tire made of 90% sustainable materials including plant-based component and recycled polyester. AWS unveiled a sustainability intelligence portal at CES that uses emissions data to help companies optimize their supply chains from mining to reuse and recycle.

We will need to continue to address the challenges and opportunities of a sustainable value chain including traceability throughout the lifecycle of EV batteries. The millions of lithium-ion batteries that power EVs will be tracked and traced through technologies like IoT and blockchain.

The Future Looks Bright

We may not be ready for flying cars to be mainstream just yet – although we’re starting to see them at high-tech shows – but it’s still a fascinating time to be in automotive. The digital future is here and OEMs who embrace technology, electrification and connectivity will win.

About The Experiences Per Mile Advisory Council

The Experiences Per Mile Advisory Council, led by HARMAN Automotive, SBD Automotive, HERE Technologies and Cox Automotive is comprised of industry executives that are studying all aspects of mobility and customer experiences. This blog was written by summarizing thoughts from members during an ideation session about Top Mobility Trends in 2022. By fueling cross-industry collaboration and driving toward the same consumer experience objectives, we can advance the connected automotive industry and introduce meaningful technology and innovation. Interested in this topic? Register to get involved today.

EPM Podcast: New Ways the Automotive Ecosystem is Personalizing the Consumer Experience

February 10, 2023 Admin Blogs

Our latest HARMAN Experiences Per Mile podcast features EPM Advisory Council Member Anthony Landamia, Director of Product Management at Xperi.

Consumers today expect their digital life to extend to every facet of the driving experience. In this new episode, guest host Jeffrey Hannah, Chief Commercial Officer of the research analyst firm SBD Automotive, chats with Landamia about the future of the digital cabin.

Landamia discusses new ways that car manufacturers can differentiate themselves and deliver unique, personalized digital experiences to both drivers and passengers. Through combining technologies like in-cabin sensing and media, the in-vehicle experience can become an adaptive, predictive and elevated space. Hannah and Landamia also discuss the outlook for connected personalization with the growth of EVs and autonomous driving.

The New Battlefield

In-cabin is emerging as the new battlefield for customer loyalty with car manufacturers competing on the interior experience. Xperi delivers a wide range of technologies that enable OEMs to win with customers through unmatched entertainment, comfort and safety solutions.

Xperi elevates content and how audiences connect with it in a way that is more intelligent, immersive and personal. Solutions are powered by a combination of best-in-class technologies and products including DTS®, HD RadioTM, IMAX Enhanced® and TiVo®. TiVo revolutionized TV with the first on-screen guide and commercially viable DVR while DTS and its masterful sound changed the motion picture experience forever with the release of “Jurassic Park.”

The company completed its spinoff in late 2022 to become an independent publicly traded entity on the New York Stock Exchange. Xperi has aggressive growth plans and a market engagement model that allows automotive OEMs the opportunity to brand the experience, retain customer ownership and actively participate in long-term revenue generation.

Sound Solutions

From crystal-clear, subscription-free digital radio to AI-powered, in-cabin sensing, Xperi seeks to transform the connected car experience with high-quality, personalized multimedia.

Available in more than 400 car models and fifty automotive brands in North America alone, HD Radio improves on already established technology – allowing broadcasters to air more channels over their frequency, all with high-definition sound. Consumers will enjoy more stations with better sound and no subscription.

DTS AutoStageTM technology turbocharges the radio experience for the connected car. The content-first experience takes the digital dashboard to new levels with relevant features like high-res artist imagery, album information, lyrics and more.

The global in-vehicle infotainment platform is designed for immersive and unified media. Armed with the content rich experience of TiVo, DTS AutoStage technology fully leverages radio, audio and video content for a personalized, next-generation consumer experience.

With a pipeline of releases and rollouts, Xperi offers OEM design and software teams an easy path to develop entertainment and content delivery in-house as well as a way to brand and monetize the in-vehicle experience.

A Safe Third Space

Interest for in-cabin sensing and intelligent interior technology is soaring considering upcoming regulations and market demand for improved safety. Xperi’s DTS AutoSenseTM solution creates safe and personalized mobile experiences with invaluable insights on drivers, passengers, children and pets.

Pioneering in-cabin technology includes single-camera driver and occupant sensing solutions. Powered by machine learning and imaging at the edge, DTS AutoSense technology transforms the cabin into a place of refuge – a safe third space outside of work or home to relax, enjoy hobbies and escape stress.

And the more you use it, the better it gets. The in-cabin experience evolves to address both internal and external stimuli. The intelligent car takes inputs from exterior and interior sensors and adjusts the interior of the cabin to match the situation and your state of mind.

Picture your smart car bringing up your favorite morning talk show as you head out on your day or your child’s must-have music on the trip home from school. “The car has the intelligence to know you, your mood and the situation, and bring you to your happy place,” notes Landamia.

Final Words

Xperi’s technology is aligned with the industry and shaping the future of it. “As we move into Level 4 and Level 5 autonomous driving, we can bring video content right into the vehicle center stack – which has been off limits up until now,” Landamia comments.

Ultimately, consumers will be the judge of advances in new technology. Beyond rating features and functions, they will evaluate the experience. Xperi is proud to be a member of the EPM Advisory Council as the group advances the use of the EPM Index, a rating system that differentiates across trip types and various vehicle models. The new metric allows consumers to compare individual vehicles based on how well they may help meet various trip needs.

The deployment of the EPM Index will help automakers and partners like Xperi design experiences that matter throughout the customer journey.

About Landamia

Anthony Landamia is Director of Product Management at Xperi where he is responsible for Connected Car products, leading the future of connectivity for the company. Landamia has more than 30 years of experience in developing and launching innovative products that enhance consumers’ ability to interface with technology across the consumer and automotive electronics industries. He previously led Subaru’s Connected Car Product Planning and Business Strategy team and served in a similar role as the head of product management for Mercedes-Benz USA Telematics & Infotainment group, where he developed and launched several innovative industry-first products. Landamia has held similar senior roles in product management and engineering at Sirius Satellite Radio, Lucent Technologies, BMW USA and Sony Electronics.

About the EPM Podcast

Now in its fourth year with nearly 9,000 listens, the EPM Podcast has engaged audiences with thoughtful conversations among industry leaders to fuel consumer innovation through cross-industry collaboration. Karen Piurkowski, Global Automotive Marketing Director for HARMAN, is the host for the Experiences Per Mile Advisory Council, with guest host Jeffery Hannah.

This is the seventh podcast where EPM Advisory Council Members have spoken about topics surrounding the next decade of mobility transformation and the consumer experience. The podcast is available on car.harman.com, explore.harman.com and experiencespermile.org and is distributed through major podcast providers. Learn more by listening to the podcast today! Click here for episode 27.

If you haven’t already done so, please subscribe to the Experiences Per Mile podcast today on your favorite podcast channel, and don’t forget to share it with your customers, colleagues and friends! We will be creating more episodes in the year to come with HARMAN thought leaders, EPM Advisory Council Members and other industry experts.

Catch up on past EPM Advisory Council episodes:

- Episode 11 – How is enterprise software accelerating Experiences Per Mile?

- Episode 12 – Can the Experience Per Mile promise be optimized via location technology?

- Episode 13 – What’s the Experience Per Mile outlook for powersport products?

- Episode 23 – Has the commercial customer been forgotten?

- Episode 24 – How is connectivity driving the EV consumer experience?

- Episode 25 – How has in-vehicle navigation evolved to satisfy consumer needs?

EPM Advisory Council Event Recap in a minute

February 2, 2023 Admin Videos

New Ways the Automotive Ecosystem is Personalizing the Consumer Experience

January 9, 2023 Admin EPM

How the in-vehicle experience becomes an adaptive, predictive elevated space

Show Notes

In this episode, host Jeffrey Hannah welcomes Anthony Landamia, a Product Management Executive at Xperi with over 35 years of automotive and mobile product management experience. Anthony talks about new ways that the automotive ecosystem is personalizing the consumer experience for the digital cabin.

Key Takeaways:

[2:13] Anthony covers why Xperi joined the EPM movement.

[3:27] Summary of the wide range of technologies Xperi provides.

[4:19] Jeff and Anthony discuss Xperi becoming an independent public company and how it affects Xperi’s strategies.

[5:44] Anthony explains how its pioneering in-cabin sensing can offer better consumer experiences in the vehicle and various use cases.

[7:38] Anthony explores the difference between HD Radio and DTS Auto Stage in terms of personalization as well as overall experience.

[9:20] How the acquisition of Tivo and Viewed complements the digital cabin and can offer OEMs and end users next generation media experiences in the vehicle.

[10:32] Xperi is taking a wholistic approach to combine technologies for better passenger experiences.

[11:54] Anthony discusses how smartphone apps and digital keys play a role in establishing personalization for drivers.

[13:17] Anthony’s outlook on personalization and connected experiences for the customer’s journey in the years ahead.

Mentioned in this episode:

Experiences Per Mile Advisory Committee

Report: Creating the First EPM Index for the Automotive Industry

June 7, 2022 Admin Reports

The automotive industry has made significant strides in the movement toward offering enhanced Experiences Per Mile over the past several years. The vehicle’s value once measured by its mechanical performance, exterior styling and driving dynamics has now changed, and it’s very visible to automotive industry “insiders.” As consumers ambitiously strive for new ways to connect to their world, both in and outside their vehicles, it’s no surprise that the way a consumer measures a car’s worth is starting to move toward the experiences provided by a vehicle.

There is a need to shape the future of personal mobility by shifting away from evaluating the speed, paint color and cornering capabilities to consumer centric mobility experiences. The future of mobility lies in redefining what “moves consumers” emotionally instead of exclusively on what “services and features are offered.”

As such, this report summarizes an exploratory research study that was conducted by IPSOS on behalf of the EPM Advisory Council to explore whether creating a new experience based metric for the Automotive industry is possible. Current measurements focus on satisfaction and quality of the features and functions inside the vehicle. The goal was to create an alternative and actionable metric to measure a vehicle based on its ability to provide the consumer with more fulfilling Experiences Per Mile.

DOWNLOAD THE REPORT NOW!

June 3, 2022 Admin Blogs

The automotive industry has made significant strides in the movement toward offering enhanced Experiences Per Mile (EPM) over the past several years. While mechanical performance and exterior looks were key considerations in evaluating a car in the past, buyers now have found a new way to measure the value of their vehicles: assessing the experiences delivered by the car. Automotive experts across the industry are watching customers prioritize finding new ways to bridge their worlds inside and outside the car purely through the connectivity-focused technologies that are elevating the in-cabin experience.

A new report was released by the EPM Advisory Council, that explores the value of creating a new experience-based metric for the automotive industry. In contrast to the currently accepted methods of measurement which focus on satisfaction and quality of features and functions inside the vehicle, the report aimed to create an alternative and actionable metric to measure a vehicle based on its ability to provide the customer with more fulfilling Experiences Per Mile. This initial “Exploratory Study” was conducted with Premium and Mainstream Compact SUV owners. Learn more about some of the key findings below.

Consumers have different goals for different trips

The first key finding is that automotive consumers have many goals as they get into their vehicles, and the prioritization of those goals varies by trip type. They’re entering the car-buying experience with various types of journeys in mind – from dropping the kids off at soccer practice to taking a business meeting on the road. The vehicle they purchase needs to be flexible enough to accommodate each of their differing needs depending on the journey they pursue at any given moment in time. Critically, research showed the accomplishment or fulfillment realized has a strong correlation with a trip’s goals, and this is crucial to a customer’s overall trip rating.

“Electrification of vehicles is creating a shift in what consumers expect from their cars. The consumer experience for the Electric Vehicle varies substantially from one with gas powered vehicles. EV owners may suffer from range anxiety, be environmentally concerned, looking for better experiences at charging stations and/or expecting the transition to electric to be seamless. Moreso, we have found that these experiences vary by trip type, vehicle type and more. Monitoring the customer experience for all vehicles will be key to survival for automakers, technology providers, suppliers and more.”

Tom Rivers

Vice President, Global Marketing

Harman Automotive & Digital Transformation Solutions

HARMAN International

The purpose of the EPM Index

Through conducting their own research with consumers with well-known industry research provider IPSOS and informed by their experience with evolving trends in the automotive space, the council developed a new EPM Index, a rating system that differentiates across trip types and various vehicle models. This key metric could assist customers in making vehicle purchasing decisions by allowing them to compare individual vehicles based on how well they may help meet their various trip needs. Just how would the EPM Index serve customers in the real world? Imagine shopping for a car, either online or at the dealership, and asking to review vehicles with the highest EPM Index rating for “Excursions,” which could be appealing to customers who often enjoy getting on the open road with family and friends. To summarize, the EPM Index could be a new metric that would help guide consumers in their very important decision of buying or acquiring a new vehicle.

“While the industry is going through explosive change and technology adoption, the question now becomes are these changes all for the better? Drivers and passengers are the ultimate ‘judge and jury’ of the next-generation mobility experience and are eager (and willing) to render their verdict. For most, their votes are only counted every 5-6 years when they shop for their next vehicle. If automakers and partners have the ability to enhance the consumer experience on a daily basis, then why wait? Creating an EPM metric at scale can enable a real-time experience feedback loop centered around key trip types and their underlying mobility goals and expectations. Unpacking and testing the key ingredients of an Automotive EPM Index and measuring them is a huge first step in that vision.”

Jeffrey Hannah

Chief Commercial Officer

SBD Automotive

Technology enthusiasts appreciate experiences delivered

Interestingly, the research also had an early indication that the technology used in the car by consumers may be critical to achieving a high score on the EPM Index. This is true particularly for consumers who tend to use and appreciate the additional tech features. Researchers felt there was an indication that the use (by the driver) of in-vehicle technology tends to help customers meet their various trip goals, thus leading to higher ratings on the EPM Indices. OEMs who focus on encouraging and training new vehicle owners to use the technology inside their newly purchased cars can potentially improve the car owner’s experience and, in turn, influence the EPM Index positively. By analyzing the impact of individual tech features on the EPM Index, it is possible to identify the features that are most and least effective in helping customers reach their trip goals, information that would prove useful to OEMs and customers alike.

The findings are clear: consumers are prioritizing customizable, connected Experiences Per Mile and in-vehicle technology features will help them get there. The EPM Advisory Council will continue to work with consumers and partners in the automotive ecosystem to explore the experiences customers need and value most. Early research findings look positive and show that an EPM Index could become a measurement of the future, particularly as we move more toward autonomous vehicles where experience is paramount. Want to dive deeper into the findings of the latest EPM Advisory Council report? Follow the link for the EPM report here: https://experiencespermile.org/reports/creating-the-first-epm-index-for-automotive-report

The Experiences Per Mile Advisory Council, is co-directed by representatives from:

- Cox Automotive, HARMAN, HERE and SBD Automotive

It is comprised of industry executives that are studying all aspects of mobility including vehicle personalization. EPM Advisory Council member companies include OEMs such as:

- Ford Motor Company, General Motors, Hyundai, Nissan NA, Polaris, Silk-FAW Automotive Group, Stellantis, Vinfast and Zoox.

Other technology-based and/or suppliers to the industry involved in the council include:

- AccuWeather, Amazon Web Services, Cox Automotive, DarkTrace, HARMAN, HERE, Intel, LG Electronics, Otonomo, Panasonic, SAP, SBD Automotive, Spotify, TomTom, Whip Mobility and Xperi.

How will Consumers Prepare for New In-Vehicle Experiences in Autonomous Vehicles?

November 17, 2021 Admin Blogs

Experiences Per Mile (EPM) can be defined as hyper-individualized experiences that solve a variety of consumer needs to help drivers and passengers maximize the time spent in their car. As a growing number of OEMs integrate more connected experiences and software-based solutions into their vehicles, measuring EPM has become critical to ensuring consumer needs are always met.

While they are still largely in development, autonomous vehicles (AVs) are already providing users with a blend of these experiences and solutions. With this offering likely to increase as they roll out, it is essential to understand their impact on EPM today. This blog will explore three perspectives that define this impact. In doing so, it will identify how experiences will change for passenger vehicles and how the industry can educate consumers on a world with AVs. It will also work to define the shared AV experience itself.

For passenger vehicles, autonomy will occur on a sliding scale, that is, the change within this sector is expected to happen gradually over time as the technology develops. AVs today are currently achieving SAE Level 2 autonomy, while vehicles capable of delivering Level 3 autonomy are currently in development. This gradual rollout complements a naturally evolving consumer experience in which the in-market technology is introduced to the customer before advancing over time. Simultaneously, the industry can leverage this rollout to research, develop, and test new customer interactions and experiences. These experiences should largely provide drivers and occupants with activities to participate in while the vehicle’s autonomous mode is enabled – providing room for OEMs and Tier 1 suppliers to deliver new experiences through entertainment and interaction between the vehicle and its occupants. However, before introducing them, the industry must ensure that autonomous vehicles, and the experiences they offer, are accessible to a broad range of consumers and are safe.

A key part in developing this accessibility is educating new vehicle owners thoroughly on the capabilities and limitations of the features they are purchasing. While this education could begin at the point of sale at the dealership or through the OEMs website, automakers could benefit from allowing the user to develop this knowledge independently. Research has indicated that most vehicle education happens during the ownership experience, meaning that new owners are likely to read educational materials, or watch related videos, after purchasing their vehicle. In relating this back to AVs, this gives the in-vehicle experience provider the responsibility of educating consumers on the easy and safe operation of autonomous vehicles with its features. There is a similar responsibility for this experience provider to demonstrate how to use these features best to deliver an optimal and personalized user experience.

In addition to ensuring a satisfactory experience is provided to consumers, it is crucial for the industry to educate the drivers of non-autonomous vehicles who will share road space with AVs. An example that proves the importance of this external education comes from Michigan, where local media announced that Google would be testing an autonomous vehicle on its state roads. However, panic was still generated when other road users in the state saw the vehicle with no one behind the wheel. It is important to note that this is just one of several testing programs taking place across the U.S., with popular automakers and technology firms (including GM, Uber, Lyft, and Apple) testing autonomous vehicles or AV technologies. One way the industry can circumvent this panic is to make sure that these drivers are, at the minimum, aware of the AVs sharing the road space. This could be carried out, for instance, through increased media coverage or partnerships and operations within local communities. It is then equally important for them to know how to deal with these vehicles, understanding that they are not all privately owned, and that not all of them will have safety drivers behind the wheel.

From both perspectives, it is just as important to understand what the shared autonomous vehicle experience will look like. Most of these experiences, such as the robotaxi, work to provide users with a journey centered on comfort and personalization. A personalized experience can take multiple forms based on both the user’s preferences and AI-powered features. Both can learn further preferences from the user through their activity, and identify any habits based on their interactions during the journey in the AV. This process often occurs through the adoption of machine-learning technologies and ultimately bring a consistency to the user experience of AVs and the services shaped around them. In the case of the robotaxi, the in-vehicle experience may include exclusive access to the AV or the partitioning of space within it to enhance privacy – emphasizing the importance of personal space and safety within one autonomous user encounter. The user’s personalized experience must also remain consistent – transferring from one vehicle to the next – requiring the industry to enable ubiquitous connectivity to do so.

The impact of vehicle autonomy will not just be limited to new vehicle owners. Other motorists will be heavily impacted by the existence of autonomous vehicles alone before learning to share road space with them. Similarly, users of autonomous vehicles and robotaxi services themselves will have to adapt to new, personalized, shared vehicle experiences. As such, the industry must ensure that all road users are taken into consideration when developing new autonomous features and even more so when developing autonomous vehicles and services.

The Experiences Per Mile Advisory Council, facilitated by Harman and SBD Automotive, is comprised of industry executives that are studying all aspects of mobility including vehicle personalization. This blog was written by summarizing thoughts from members during brainstorming sessions about the Autonomous Vehicle Experience. By fueling cross-industry collaboration and driving towards the same consumer experience objectives, we can advance the connected automotive industry and introduce meaningful technology and innovation.

Are Experiences Per Mile Different for Electric Vehicle Owners?

October 6, 2021 Admin Reports

For consumers today, buying an EV looks very different than a traditional vehicle purchase. There is more research, training and contemplation – while the lifecycle of ownership also has several added aspects to consider. The report shows ‘consumer personas’ developed to illustrate the impact EVs have on varying consumer profiles. It explores how collaborative, consumer-centric innovation is critical to promoting better experiences.

The new EPM Advisory Council Electric Vehicle Experiences report summarizes that Experiences Per Mile are indeed different for EV owners compared to ICE owners, requiring new considerations, industry collaboration and EV-centric design to support consumers as they make the transition to electric vehicles. As consumer preference changes, so will their experiences. As vehicle powertrains are shifting, so is the connected world, colliding to create new opportunities and hyper-individualized experiences that solve for real consumer needs. It is no longer a question of if, but when, will the mass adoption of EVs effect your business.

DOWNLOAD REPORT NOW!

Are Experiences Per Mile Different for Electric Vehicle Owners?

October 5, 2021 Admin Blogs

Experiences Per Mile can be defined as hyper-individualized experiences that solve for real consumer needs to help people maximize the time they spend in the car. The Experiences Per Mile Advisory Council, formed by HARMAN International and SBD Automotive, comprised of Industry Automakers, Tier One Suppliers, Third-party Providers, and other industry leaders, set out to answer this thought-provoking question in their mission to better understand and improve the consumer experience.

As the Advisory Council investigated the Electric Vehicle Industry, they uncovered interesting findings through quantitative and qualitative research studies, by interviewing EV thought leaders and through brainstorming sessions with EPM Advisory Council members. They formed a new report, “EPM: Are Experiences Per Mile Different for Electric Vehicle Owners?” The report findings are based on two fundamental assumptions:

- The adoption of EVs will proliferate, and

- The global charging infrastructure will catch up and meet the level of demand.

However, we are now in a unique moment of time where new opportunities are present for providers and consumers alike.

Top 10 new dynamics in the Electric Vehicle Market

Described in the EPM Advisory Council Electric Vehicle Experiences Report

- The major conclusion of the new report is: ‘Experiences Per Mile’ are different for electric vehicle (EV) owners compared to traditional ICE vehicle owners.

- The transition to an electric future is affecting consumers across the world differently and shows a different pace of adoption by major regions.

- Collaborative, consumer-centric innovation is critical to promote better experiences for the Electric Vehicle future.

- The EV consumer is looking for a better experience more now than ever before and is at a state where he/she can finally appreciate various Experiences Per Mile solutions.

- There is an opportunity to conquest customers from competing OEMs during the global electrification race, due in part to the lack of available EV options by every manufacturer.

- The EV value chain is complex and adds several layers, integrating markets that were not closely linked to the automotive industry in the past.

- Electrification affects the entire consumer lifecycle, from purchase consideration through the secondary market, creating new business opportunities for automakers and other businesses throughout.

- The EV Market attracts distinct ‘consumer personas’ included in the report in this early market stage. It is expected that this will change as wider adoption occurs.

- EVs are flagships for new technology, creating new opportunities and risks for the entire automotive industry and creating a stronger demand for Over-the-Air Updates for EVs and charging stations.

- As vehicle powertrains are shifting, so is the connected world, colliding to create new opportunities and hyper-individualized experiences that solve for real consumer needs.

EV Behaviors Today

Today, we’re seeing significant investments from across the industry – OEMs and the broader ecosystem are accelerating the development electrification of vehicles, creating new infrastructure needs and forming new support networks. At the same time, consumer interest is skyrocketing and their demand for EV-specific experiences is growing. We are at the precipice of a rare opportunity that if actioned on, will fast-track EV adoption and change our roads, how we drive and even where we go. EVs are flagships for new technology, creating new opportunities and risks for the automotive industry.

Experience Expectations

Global action, supply chain challenges, and environmental impact are among the largest external impacts for the EV market today. This is compounded by heightened consumer expectations for brands and the experiences they demand. The automotive industry is already transforming and evolving towards an electric future. Global EV sales are exhibiting strong growth, OEMs are setting aggressive product and investment targets, and the voice of the consumer is becoming a sounding board for innovation and environmentally conscious design. This report explores global consumer surveys conducted by SBD Automotive and HARMAN. It illustrates that this change is occurring differently in three major geographies: China, EU and USA.

The report is clear in that there are still existing barriers to adoption. Charging infrastructure requires continued development in both physical availability and the overall user experience, while availability of range based on charge continues to be a leading concern voiced by consumers considering EVs. These all form a new set of consumer expectations.

The New EV Experience Cycle

For consumers today, buying an EV looks very different than a traditional vehicle purchase. There is more research, training and contemplation – while the lifecycle of ownership also has several added aspects to consider. The report shows ‘consumer personas’ developed to illustrate the impact EVs have on varying consumer profiles. It explores how collaborative, consumer-centric innovation is critical to promoting better experiences.

The new EPM Advisory Council Electric Vehicle Experiences report summarizes that Experiences Per Mile are indeed different for EV owners compared to ICE owners, requiring new considerations, industry collaboration and EV-centric design to support consumers as they make the transition to electric vehicles. As consumer preference changes, so will their experiences. As vehicle powertrains are shifting, so is the connected world, colliding to create new opportunities and hyper-individualized experiences that solve for real consumer needs. It is no longer a question of if, but when, will the mass adoption of EVs effect your business.

The EPM Advisory Council was formed to align automakers and other industry stakeholders in the connected movement, and to encourage collaboration regarding the changing value chains in the automotive industry. This report was written by members of the EPM Advisory Council.

For more information, download the report EPM: Are Experiences Per Mile Different for Electric Vehicle Owners?

How has in-vehicle navigation evolved to satisfy consumer needs?

September 23, 2021 Admin EPM

Improving the in-vehicle navigation experience

Featured in this episode is Paul Hohos, Vice President of Automotive Sales and Managing Director for Americas at TomTom. During the discussion, Paul describes how personalization is being added to embedded in-vehicle navigation to improve user experience, and much more.

Key Takeaways:

[1:42]: Paul explains what Experiences Per Mile means to him

[2:30]: Why TomTom became involved in the EPM movement

[2:58]: Why TomTom is focused on creating positive in-vehicle experiences for customers

[3:34]: Consumer perception of embedded in-vehicle navigation

[6:27]: How navigation has changed recently and how TomTom has contributed to this change

[7:26]: What it will take for consumers to leave phone navigation behind

[8:40]: What can be done with vehicle navigation to reduce barriers to entry for electric vehicles

(EVs)

[11:05]: Other ways TomTom is improving the in-vehicle experience for drivers

[12:09]: Opportunities to partner with other organizations to deliver more differentiated services

for consumers

[13:58]: Paul’s vision for the future of vehicle navigation

Sponsors

Brought to you by HARMAN

Mentioned in this episode: